Why Choose Risk Assurance

Risk assurance involves multiple tiers of internal processes including management and internal controls financial control and security inspection compliance and internal audit. Explore our insights on delivering Risk Assurance services through innovative people with a passion for helping clients manage risk.

Three Lines Of Defense A New Principles Based Approach Guidehouse

But on companies such as KPMG PwC and DT Risk Assurance is a large field in the major consulting companies and has a wide variety of projects.

Why choose risk assurance. Speaking from experience working on large risk pro. Determine the existing controls and analyse risks in terms of consequence and likelihood in the context of those controls. Identify what why and how things can arise as the basis for further analysis.

Answer 1 of 4. Risk assurance is the most boring part of auditing. Risk management is the macro-level process of assessing analyzing prioritizing and making a strategy to mitigate threats to an organizations assets and earnings.

Achieve intelligent automation goals and manage associated risks. Keep reading to learn why risk management plans are an important element of successful businesses. This model of risk assurance organizes reporting around risk themes.

To read why Risk Management in 2019 is more important than ever click here. A risk assessment is performed to provide an in-depth look at asset sensitivity vulnerabilities and threats to determine the residual risk and recommendations for existing and proposed safeguards. Banners Call for Parts creates a steady workflow and pinpoints critical issues.

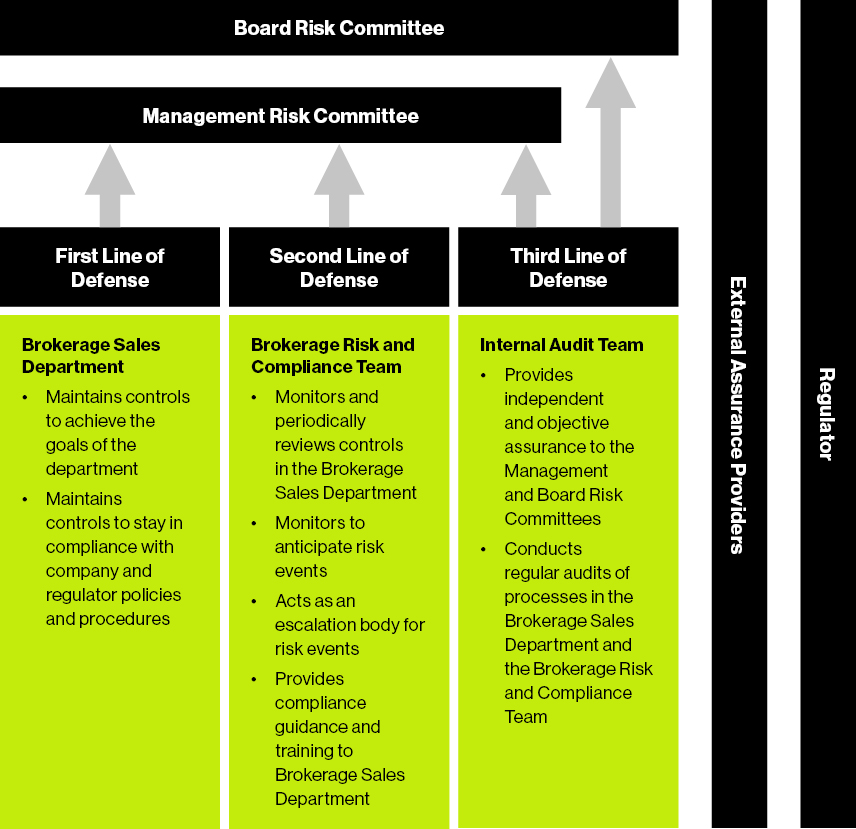

Core assurance means standard auditing while risk assurance means auditing of IT controls. Following internal processes assurance requires an external audit team who examines the internal processes effectiveness and reports to senior management with successes and areas for redevelopment. Accepting risk assumes various financial and organizational approaches meant to provide a financial buffer during risk materialization.

Nevertheless the risk management position is currently one of the most well-respected positions in firms and companies. Criteria against which risk will be evaluated should be established and the structure of the analysis defined. The insight and independent assurance we bring provides an invaluable safeguard in todays complex operating environment.

Risk assessment is a meso-level process within risk managementIt aims to breaks down threats into identifiable categories and define all the potential impact of each risk. We have earned the excellent reputation which we enjoy today and we look forward to nurturing it long into the future. The key difference between Audit vs Assurance is that Audit is the systematic examination of the books of accounts and the other documents of the company to know that whether the statement shows true and fair view of the organizations whereas the assurance is the process in which the different processes procedures and the operations of the company are analyzed.

Most people I know in these types of positions PwC and elsewhere exit to an IT auditing or accounting position in industry or a straight accounting role to try to escape the IT label. Risk is a fact of life. Internal audits rise of intelligent automation.

Since 2002 we have offered a combination of competitive pricing first class service standards an outstanding record of claims settlement and since 2007 the unquestionable security of Lloyds. The importance of risk management in business cannot be understated. However the job can also be challenging especially when there are turbulent risk factors that affect the firm.

Risk management plans help a business determine what their risks are in order to reduce their likelihood and provide a means for better decision-making in order to avoid future risk. After outlining the types of risk inherent in your business youll want to determine their criteria and likelihood of happening. What is a Risk Assessment and Why is It Important.

We have already established that the internal auditor seeks to provide reasonable assurance that the controls in place are appropriate to manage material risks within the organisational appetite. The recommendations implemented are factored into the original security requirements to revise the security assurance requirements. Those drivers also dictate the assurance priorities that need to align with business strategy and operations.

As an auditor you should assess both which risks are material to the process area system risk subject being audited and what control principles would manage them. We work with our clients in their boardrooms and their back offices delivering business control to help them to protect and strengthen every aspect of their business from people to performance systems to strategy business plans to business resilience. While risk acceptance offers a net financial return the optimal decision to its adoption relies on a managers perspective and not on systematic threats of the market.

Groupings of similar or related risks that can most affect the drivers of value. By outlining the technical and regulatory risk and assessing its likelihood a risk assessment matrix can help to prioritise and allocate resources to help mitigate such burdensome pressures. Within RSM risk assurance is designed to help our clients first of all to identify the risks that they face if they havent done so.

CEOs are concerned that exchange rate volatility has a big impact on organisations growth. While it is always best to refer to the standards when planning a risk assessment here are a few answers to some commonly asked questions. Secondly make sure they have adequate controls in place to manage those risks or if they havent got adequate controls recommend improvements such as they can manage those risks.

And gain a competitive advantage. Plan and execute the risk assurance cycle. My answers do not focus on the strategy companies such a McKinsey and BCG etc.

Prepare for whats around the corner.

Musings On Project Management Requirements Feasibity And Risk Assessment Guide In 2021 Project Risk Management Risk Management Project Management Professional

Business Risk Register Template Excel And Construction Risk Register Template Excel Risk Matrix Risk Analysis Corporate Risk Management

Risk Tolerance You Can Find This And More Graphics Like It At Www Srmam Com Risk Management Risk Tolerance

Different Coverage In 2021 Home Insurance Insurance Coverage Insurance Agent

Business Insurance Explained By Risk Management Advisor Business Insurance Risk Management Insurance

This Is Why You Must Get A Comprehensive Car Insurance Infographic Comprehensive Car Insurance Car Insurance Car Insurance Tips

Risk Assurance Audit Services Pwc Ireland

Risk Assurance Audit Services Pwc Ireland

Articles Aurorasa Coaching Emotional Intelligence Training Inspirational Quotes Leadership Inspiration Emotions

10 Step Risk Management Kick Off For Your Project Risk Management Project Risk Management Management

Digital Trust Risk Assurance Pwc Middle East Mind Map Design Ecosystems Technology

Risk Assurance Audit Services Pwc Ireland

Software Development 7 Phases Of Design Development Process Software Development Life Cycle Software Development Development

About The Cyber Security Audit Reports Cyber Security Security Audit Cyber

Telecharger Information Assurance And Security Technologies For Risk Assessment And Threat Management Advances Auth Security Technology Assessment Ebook

Risk Assurance Audit Services Pwc Ireland

Posting Komentar untuk "Why Choose Risk Assurance"