Term Assurance Plan Meaning

There are several types of Term Assurance. The sum assured under the policy is only paid out if death occurs within a specified term.

Seven Disadvantages Of Rider Insurance Policy Definition And How You Can Workaround It Rider Insurance Pol Business Insurance Life Insurance Policy Insurance

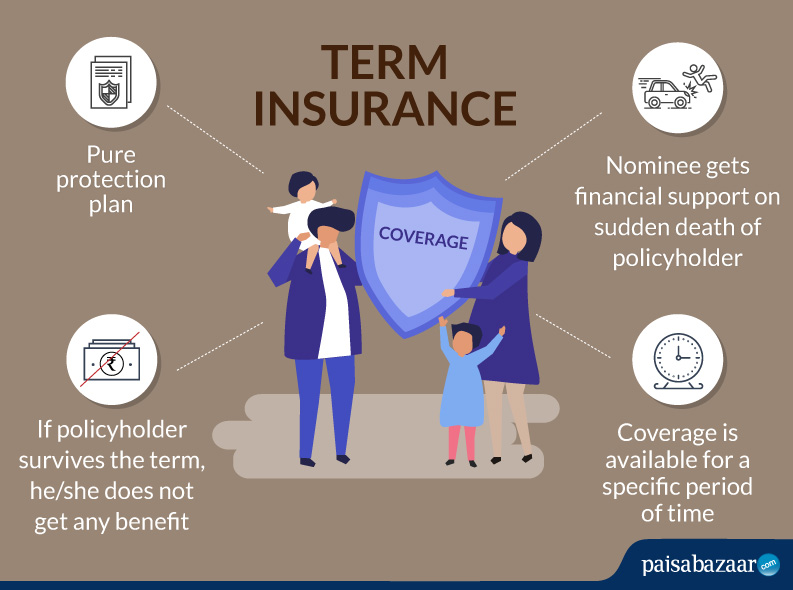

A term insurance plan is the most affordable form of life insurance cover.

Term assurance plan meaning. The term is also fixed. Find out how level decreasing and increasing term insurance works and how to get the right cover for you and your family. Term life insurance covers you for a specified amount of time or the term of the policy.

But term plans do not give anything back at the end of the term life cover period if you outlive it. This type of policy is useful for providing security for your dependents up to a certain age. You can choose the length of time you want whether it be 1 year or 50 years.

Policy document _Reliance Group Term Assurance_V_A20 UIN - 121N006V02 Page 3 of 24 General description of the plan Reliance Group Term Assurance Plan is a non-linked non-participating one year renewable group term assurance plan where the benefits are paid only on. Production testing packaging and delivery. Term insurance is a pure life insurance product which provides financial protection in case of death of the life insured during the term of the policy.

This is the most basic and simple form of term insurance where the sum assured is fixed throughout the policy tenure and benefits will be paid to the nominee on the death of the life insured. It is designed to financially protect ones family in case of death of the bread-earner. Likewise the maximum age limit for buying a term insurance plan is 65 years.

There are two common terms widely used in the world of life insurance - non-participating and non-linked. As a thumb rule you are allowed to buy a. The QA team is involved in all stages of a products development.

All insurance providers offer plans with unique terms and conditions. However as per the general norms the minimum age limit for buying a term insurance plan is 18 years. To cover an interest-only mortgage or to provide a lump sum for your family.

A term assurance policy is a type of protection insurance. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. So make sure that you fall under this age group if you wish to buy a term plan.

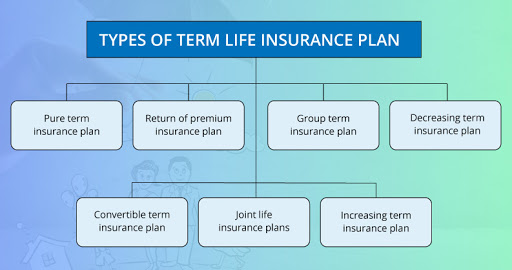

A term insurance plan does not provide maturity benefits like traditional money back or market-linked life insurance policies but provide much higher. Joint Life Term Plan - where the policy covers the life risk of. Read on to know the meaning of these terms and how they are linked to a term life insurance plan.

Whats the Difference Between Quality Assurance vs. There are two different types of term life. Decreasing term assurance How it works and when it is useful.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. However most people use life assurance polices for IHT planning both as a means of protecting the policy value from IHT and as a way of giving their beneficiaries a lump sum with which to pay the IHT bill on their estate. 20 crore depending upon your income.

Decreasing Cover Term Plan where the life coverage decreases steadily at a fixed rate till it reaches the threshold limit. In contrast quality control QC is a narrower process. TROP Return of Premium Plans.

A term plan cushions your dependents from financial risks and helps them take care of their needs and liabilities in your absence. Term plans are no frills products that give us very high life covers for very low premiums. Term Life Insurance.

Generally in a term plan you are allowed to choose the sum assured you require ranging from Rs 10 lakh to Rs. A decreasing term assurance policy is usually the same as a mortgage term assurance policy. Quality assurance is a broad process for preventing quality failures.

If the insured dies during the time period specified in the. Term insurance policy - Term insurance plan is a form of life cover it provides coverage for defined period of time and if the insured expires during the term of the policy then death benefit is. Often people think about when their dependants may start earning their own income or the number of years left on a mortgage.

Premiums stay the same for the whole term. Level Term Plans where the life coverage remains the same throughout the policy tenure. Level Term Assurance can be used if you need a specified amount of cover for a certain length of time eg.

Click to open Level term assurance. Term life insurance or term life assurance provides a cash lump sum for your loved ones if you die within a set period. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end.

Life assurance is a good choice if you want to make sure your loved ones receive a payout whenever you pass away. Increasing Cover Term Plan where the life coverage increases steadily at a certain fixed rate of about 5 every year. Your policy may cover you your partner or both of you depending on the cover.

In the event that the policyholder dies the insurance payout would be sufficient to clear the. Check Term Insurance Meaning on Max Life Insurance. A type of life insurance with a limited coverage period.

Answer 1 of 32. Payment is made if you die during the term. Term Insurance is the pure Life Insurance plans that offer financial security to your loved ones future even in your absence.

If the life assured survives until the end of the term the policy will expire and there will be no monies payable. This is known as the term. A term assurance policy will be set up for a specific number of years.

Term Assurance is life insurance in its cheapest form. In this case the protection is for your family or other financial dependents as it will provide them with a payment in the event of your death. Click to open Decreasing term assurance.

What Is Term Insurance Term Insurance Definition Meaningaegon Life Blog Read All About Insurance Investing

What Is Term Insurance Everything You Need To Know Term Insurance Life Insurance Policy Life Insurance Companies

Term Insurance Plan Watch This Video To Know What Is Term Insurance Plan And How It Is Beneficial Let S Understand Term Insurance Best Insurance How To Plan

What Is A Money Back Policy Meaning Of Money Back Life Insurance Policy Life Insurance Policy Life Insurance Premium Insurance

Pin By Smithshah On Insurance Term Insurance Life Insurance Companies Insurance

Don T Wait Too Long Get Insured Today Life Insurance Facts Life Insurance Marketing Ideas Insurance Ads

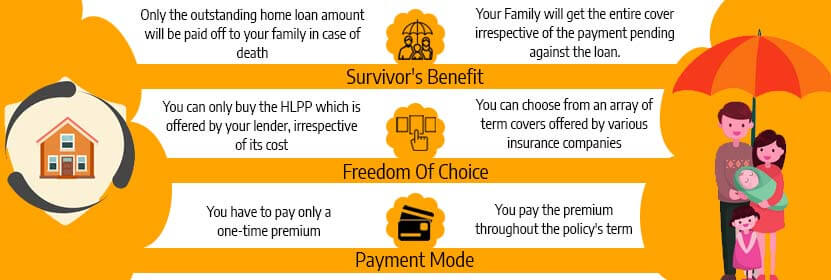

Hlpp Vs Term Insurance Which Is Best If You Have A Home Loan

Here Are All The Reasons You Don T Need Life Insurance Insurance Life Life Insurance

What Is A Term Insurance Plan Term Insurance Term Life Insurance Life Insurance Companies

What Is A Manager Definition And Meaning Market Business News What Is A Manager Management Vp Marketing

Image Result For Well Being Definition Wellness Important Things In Life Your Best Life Now

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

60 Plus Mediclaim Policy For Senior Citizens Health Insurance Plans Senior Citizen Medical Tests

What Is A Whole Life Insurance Policy Plan Life Insurance Policy Life Insurance Life Insurance Agent

Term Insurance Coverage Claim Exclusions

July Insurance Marketing Calendar Agency Updates Insurance Marketing Insurance Marketing Marketing Calendar Social Media Schedule

Term Insurance Coverage Claim Exclusions

Better To Invest In Term Plans Than Return Of Premium Ones Businesstoday

Posting Komentar untuk "Term Assurance Plan Meaning"